By hooked, I mean enjoying something very much, as the Oxford Dictionary describes the word in an informal sense. That something is Hedgeye Risk Management, and the innovative investment process created by its founder and Chief Executive Officer Keith McCullough.

I don’t need or want an intervention, not because I’m delusional or stubborn. Hedgeye’s risk management process has been a revelation for me in better understanding how the markets (the Flows of the Machine) work and in discovering a new way to invest, that is:

Global macro,

Data-driven,

Rules-based,

Focused on a full investing cycle,

Narrative and conflict-free,

Emotionless.

Hedgeye’s mantra is preserve, protect and compound your capital.

The Greatest Productivity Hack

David Salem describes the Hedgeye process succinctly, calling it:

“The greatest productivity hack he’s encountered as an investment pro.”

Salem’s words carry weight. Prior to joining Hedgeye as Managing Director of Capital Allocation, he was a client of Hedgeye. Before that, Salem served as founding President and Chief Investment Officer of The Investment Fund for Foundations (TIFF), and was a partner at global investment advisory firm GMO, where he worked with Jeremy Grantham on the design and execution of investment solutions for large institutional funds.

Salem was so impressed by the Hedgeye process he joined the company. (A variation of the late Victor Kiam, who was so impressed by the Remington electric shaver his wife had given him, he bought the company.)

1979 Remington Ad

If someone as experienced as Salem holds the Hedgeye process in such high regard, then I know I’m on the right track.

Hedgeye’s numbers and rules-based system is helping me replace uncertainty, indecisiveness and emotion with clarity, action and to feel nothing when buying or selling a stock.

The Hedgeye process, among many other features, hand picks long-term investing ideas for me based on rates of change in global economic data, fundamental research focused on rates of change in revenue, EBITDA, and free cash flow combined with McCullough’s proprietary quantitative method, which determines whether the stock has positive or negative signal strength.

The process also gives me a formula to follow when trading around a position - when to add, when to take some profit, when to reduce exposure and when to sell. Again, all based on numbers and not narratives and emotion.

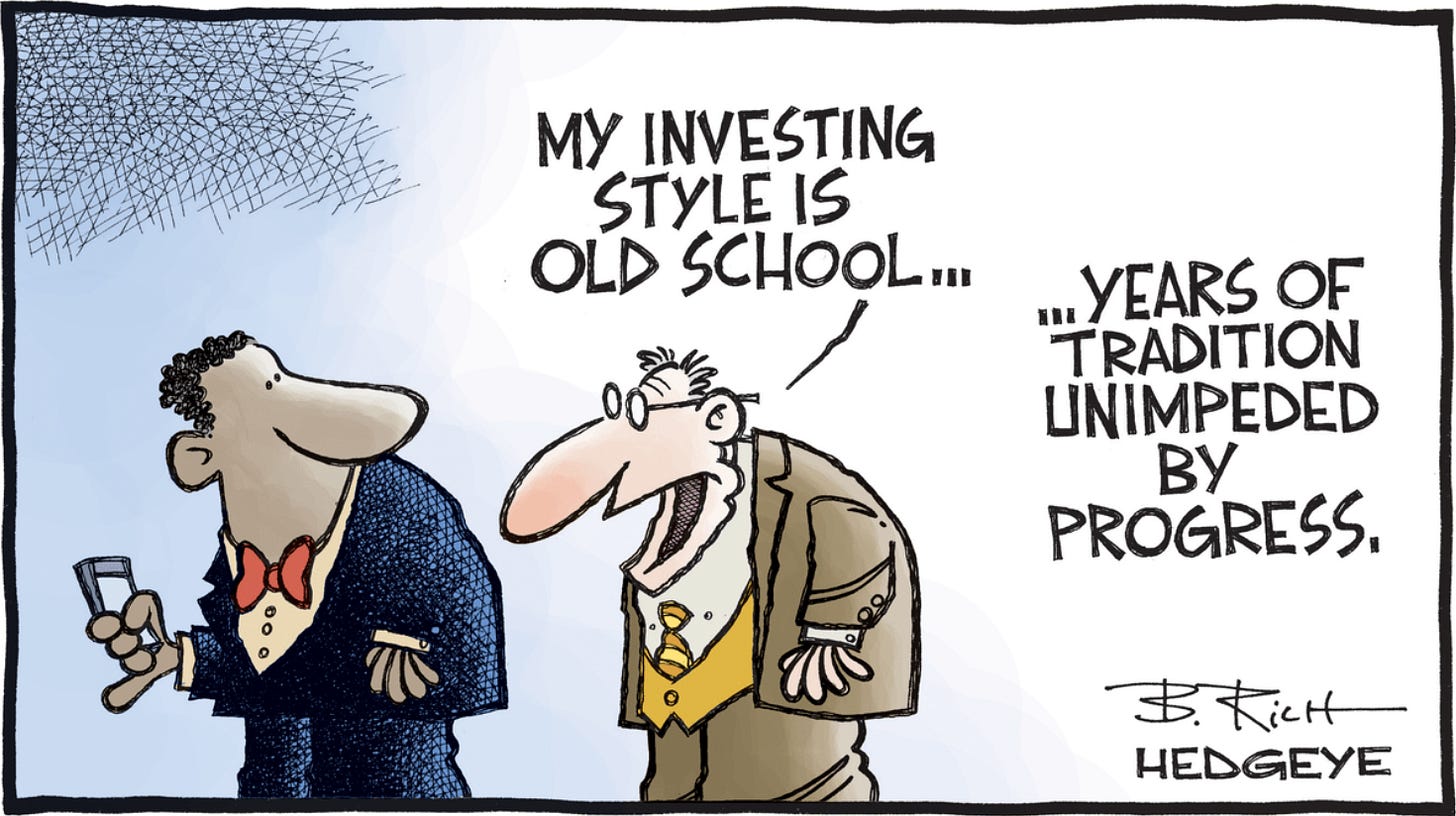

This is after years of being exposed to traditional buy-and-hold, 60/40 investment strategies and working in mainstream financial media, which is filled with smart and well-meaning people, but often fraught with faulty speculative narratives, groupthink and pundits opinions not backed by data.

I’ve been guilty of perpetuating those speculative narratives when, for example, during a market report I would say something like, “Technology stocks were higher today because of ... (fill in the blank) ...” I was often just regurgitating a narrative that several media platforms were saying in unison.

It was not possible to attribute the actions of millions of people trading trillions of dollars in assets to just one thing. I knew there was something happening under the hood of the market and Hedgeye has helped me better understand what those things are such as the impact programmed, multi-trillion dollar volatility control funds have on the direction of the S&P 500.

Hedgeye’s Edge

McCullough founded Hedgeye in 2008 during the depths of the financial crisis after getting fired the previous year as a hedge fund manager for being too bearish. Today, Hedgeye has grown to over 100 employees, including over 40 analysts, seven of them focused on global macroeconomics.

Hedgeye is unbiased in its research because it has no investment banking arm and does not accept advertising dollars. The company generates revenue from institutional clients with more than $10 trillion dollars in assets under management, and from do-it-yourself (DIY) investors like myself, who subscribe to their various research products. (McCullough recently said the company has started Hedgeye Asset Management “behind the scenes.”)

As a Macro Pro subscriber, in effect, I have a team of analysts working for me providing high-quality, fundamental hedge fund research and investment ideas.

Then, McCullough puts those ideas through his fractal math-based system to determine positive or negative signal strength based on the price, volume and volatility of the stocks over time periods of three weeks or fewer (trade), three months or more (trend) and three years or fewer (tail).

(For a full explanation of the Hedgeye process, check out the Education Center and Hedgeye University, where McCullough gives a video masterclass. It’s free.)

Before I continue, I want to emphasize three main points about what you’ll be reading in this series:

First, my retirement money is being managed by a capable and successful long-only money manager, my wife. I deploy the Hedgeye process in my personal account.

Second, I’m starting this series as a creative outlet because I’ve realized I enjoy Hedgeye’s data, information and content in a vacuum. My wife exudes tolerance and patience in hearing me prattle on about Hedgeye, but only to a point. Most colleagues, friends and other family members have only heard about Hedgeye through me, so there’s no one to share with what is a consuming part of my life.

Third, I don’t intend for this series to be considered investment advice, instructional nor promotional. The best way to learn about the Hedgeye process, which requires one to be an empty cup and to discard most of what you’ve learned about traditional ways to invest, is to use Hedgeye’s educational tools, which are free and plentiful.

Impressive Track Record

McCullough’s track record is a big reason I’m a believer in the Hedgeye process. At its core, the system, according to Hedgeye, “…measures and maps economic data across countries around the world to identify key inflection points via our proprietary Growth, Inflation, Policy (GIP) predictive tracking algorithm.” This “regime-based framework” separates the rates of change in growth and inflation into four quadrants.

Quad 4, for example, is when both growth and inflation are slowing. A deep Quad 4 is when “the shit hits the fan.” McCullough has called every one of them correctly since 2008, along with 2018, 2020, 2022, and the most recent decline for major stock indices this year.

That’s because McCullough built his process, in basic terms, to have his signals front run growth, inflation, and the interest rate policy of the United States Federal Reserve (Fed), and other central banks.

Uncanny Proficiency and Accuracy

The proficiency and accuracy of the Hedgeye system was again in evidence in mid-July this year, when McCullough cautioned his institutional clients and DIY subscribers that the U.S. economy, among other G20 countries, was “phase transitioning” from Quad 3 (stagflation), to Quad 4 (deflation).

He recommended selling certain asset classes and sector styles such as commodities and technology, and rotating into asset classes and sector styles that back test well in that environment, such as various types of bonds, gold, utilities, health care, and real estate investment trusts (REITs).

Courtesy Hedgeye

Hedgeye vs. Macro Tourists

While the Hedgeye process braced users for the market downturn, “macro tourists” who followed the latest narrative and catchy phrase trumpeted by the mainstream financial media were being told about the “Great Rotation” into small-capitalization stocks.

The Russell 2000 had been higher for 11 of 16 trading sessions and CNBC was trotting out Tom Lee, Fundstrat Global Advisors’ founder and head of research, for the umpteenth time, who said small caps could surge 15 percent in August.

What happened next lies at the heart of McCullough’s combative us vs. them mentality. His mission is to continue to disrupt and “tear down, brick-by-brick”, what he calls Old Wall Street, to protect investors from poor advice and from listening to pundits who are “garrulously ranting permabulls that have no model.”

Nailing Quad 4 Again

The downturn for major stock market indices McCullough’s signal had been flagging manifested itself, culminating on August 5 in one of the largest-ever spikes in the volatility index (VIX) tracking S&P 500 options, and a dramatic global market sell-off.

Bond values soared and yields plunged as investors priced in multiple interest rate cuts from the Fed. Many investors were blindsided. Meanwhile, Hedgeye users, if they followed the process, would have avoided the worst of the decline and may have only experienced modest losses or even small gains.

Oh, and that Great Rotation? The financial media’s headlines did a 180 in fewer than three weeks from ones like this:

Courtesy livewire

To headlines like this:

Courtesy Bloomberg

Those articles were backward-looking and of zero value to investors as the Russell 2000 Index experienced an explosion in volatility, resulting in a nearly 12 percent plunge over three days, marking the largest decline since the crash of 1987.

Before the panic, the correct rotation was not into small caps but historical Quad 4 performers like fixed income, gold, utilities, health care, and REITs. The Russell 2000 index finished August higher by 5.14 per cent after the volatility event but has vastly underperformed utilities, for example, over the last six months.

In early September, Lee, usually always bullish, said he expected a 7-to-10 percent drop in the S&P 500 in the next two months. The broad index just wrapped its worst week since March 2023, down 4.3 percent.

McCulloughs’s signals and the research of Felix Wang, Hedgeye’s Global Technology Sector Head and Software co-Sector Head, also sniffed out that the mania for artificial intelligence-related stocks, powered by NVIDIA, was subsiding as the semiconductor maker’s stock failed to surpass its peak in June, started hitting lower highs, broke Hedgeye’s bullish trade and trend levels, and turned bearish trade and trend.

NVIDIA has declined 24 percent from its all-time high and semiconductor stocks just finished their worst week since the depths of the pandemic in March, 2020.

Once again, the real-time clash between Hedgeye’s data-driven approach and the ever-changing narratives of Wall Street and the media was clear. It was further proof that I’ve found a better way to invest.

Now, have I become a master of the Hedgeye process and wildly rich after having been a subscriber for three years? Not yet. But Hedgeye’s research and content is a big part of my everyday routine. I’m always trying to strengthen and refine my thinking, decision-making, and overall approach to investing.

Here’s a partial list of things I’m trying to get better at:

Patience - McCullough has said it’s the one thing he would preach to his younger self.

Fear of Missing Out (FOMO) - or put a better way: Don’t chase!

Bag holding - cut your losses early. Don’t let a five percent loss turn into a 50 percent loss. Feed your winners, starve your losers.

Indecisiveness - get in the game. If a Hedgeye analyst said they’ve added a certain stock to their Best Idea Long list and if McCullough’s signal confirmed the stock has strength and is bullish trade and trend, don’t dither, buy it!

Further to that last point, Stanley Druckenmiller, the legendary investor McCullough often cites, said in an interview, and I’m paraphrasing, if he’s done research on a company and likes what he sees, he buys it.

Then, Druckenmiller has his research team at Duquesne Family Office do more work on the company to confirm or reject his thesis. If the analysts agree with his view, he’ll buy more. If they don’t, he’ll sell it.

In Part Two, I’ll detail how I incorporate Hedgeye’s wealth of data and information into my daily routine, including three key things investors should do every day to successfully risk manage their portfolio as a full cycle investor.

**

Next Saturday: Anything You Do is Everything You Do.

Disclaimer: I do not have a financial arrangement with Hedgeye Risk Management. Dan Holland, Hedgeye’s Head of Media and Public Relations, has been gracious in making my writing available on Hedgeye’s website.