One of the best things an investor can do when learning the Hedgeye Risk Management investing process is to read the books by “financial market founding fathers” that Keith McCullough recommends because he owes them a debt of gratitude and they are essential pillars in his approach to investing.

The Misbehavior of Markets by the late mathematics legend Benoit Mandelbrot is one of three foundational books Hedgeye’s Founder and CEO cites on the company’s website as, “somewhat of a Bible to me.”

“I learned a ton from this guy, if only what not to do,” McCullough said. “It’s an alternative to establishment economics. It’s an alternative to how people think about markets relative to economic data.”

In a message to McCullough a couple of years ago after I interviewed him for the first time, I told him I was planning to read Mandelbrot’s book. McCullough responded, “Mandelbrot will blow your mind.”

Reading the book definitely expanded my mind and Mandelbrot’s concepts changed the way I understood how markets work.

I used to think the stock market was a massive, chaotic system that was unknowable because how does one ever understand the actions of millions of global traders, investors and programmed machines?

Mandelbrot helped me see order in the chaos and fractal symmetry in that all trades are part of a unified, connected whole. Mandelbrot’s work discovered fractal geometry patterns and relationships within the market amid bursts of turbulence.

The Mandelbrot Set, an image McCullough frequently uses on social media.

These concepts were essential for McCullough in devising his process, which uses fractal math at its core and measures and maps nothing but numbers - price, volume and volatility, and the volatility of volatility. This approach results in a repeatable, rules-based process to help investors get ahead of the next big macro trend and better risk manage their money.

Perfect Quad 4 Record

Hedgeye’s track record proves the process works. McCullough’s signals have correctly identified several major market phase transitions, including every major downturn, or Quad 4, since 2008.

But he’s no permabear having gone bullish in April 2009, and riding other bull markets, including the “everything” rally into November 2021 before his signals told him to turn cautious, which allowed Hedgeye clients and subscribers, who listened and acted accordingly, to avoid a terrible year for stocks in 2022.

The latest example of the Hedgeye “Go Anywhere” global strategy working started in mid-July this year when McCullough’s signals indicated a phase transition from Quad 4 in the U.S., where both economic growth and inflation are decelerating, to a global Quad 2, growth and inflation accelerating, and a Quad 3 in the U.S., with growth slowing and inflation rising.

This transition had McCullough recommending to get out of the U.S. dollar, buy various foreign currencies, stay invested in gold, utilities, and REITs, add consumer staples, various commodities, technology and emerging market equities, and to reduce exposure to various types of bonds and health care.

Thinking Fast & Slow

Another “must-read process book” according to McCullough is Thinking Fast & Slow by Daniel Kahneman, the Nobel Laureate and founder of behavioral economics, who died this past March at 90.

“This book provides a real baseline for understanding, “What is behavioural finance?” McCullough said. “What this book does is it teaches why human beings should embrace uncertainty.”

The one thing I remember from reading Kahneman’s book years ago is the concept that human beings often think fast by making decisions instinctively and emotionally, which can often lead to subpar results, and those that think slower with more deliberation and logic often make better decisions.

McCullough also believes every investor should consider Models of My Life by the late Herb Simon as the third foundational book. Simon won the Nobel Prize in Economic Science, the Turing Award in computer science, and is considered a pioneer in artificial intelligence.

“I’d like to thank Mr. Simon for being not only a revolutionary in this space, but for challenging the status quo,” McCullough said. “That’s a really important component of this book. It contextualizes where we were in economics back in the 1970s and outlines a better path forward.”

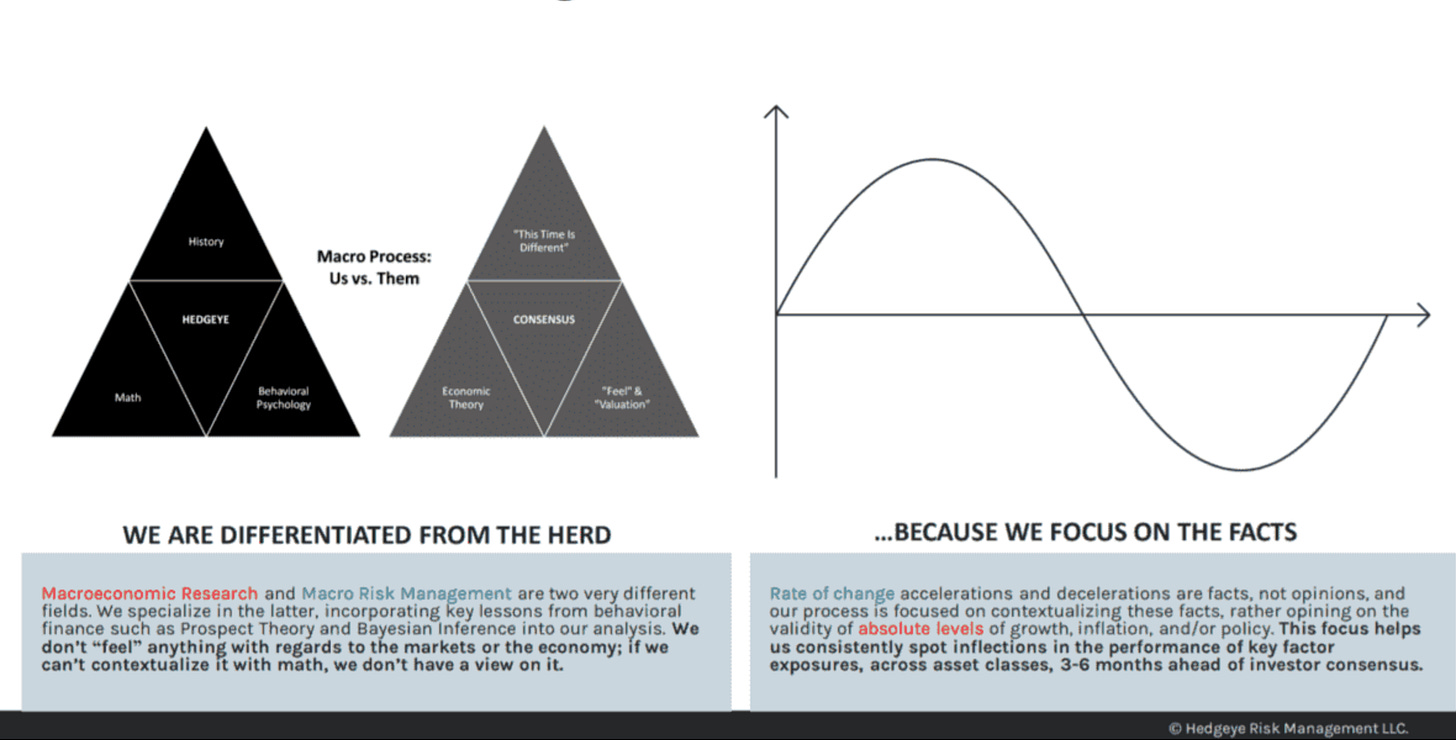

These three books are essential pillars of the investing process McCullough created around 2008 and has been strengthening ever since. The Hedgeye method differentiates from consensus by using math, behavioural finance, and the rate of change. Here’s how Hedgeye explains its macro process.

Sierpinski Triangles (or Gaskets, Sieves) on the left. Sine Wave (or Curve) on the right.

I have discovered and enjoyed many books by buying what McCullough recommends. He reads books focused on math, history or behaviour, and tries to read a book every 10 days, a pace I aspire to but cannot emulate at the moment. Reading books before bed doesn’t help, as I often only get through a few pages before nodding off.

I’ve also tried the Bill Clinton technique of having four books on the go, so if I get bogged down with one book, I can shift to another one. The problem with that is sometimes my nightstand becomes piled with books that are in various stages of unfinishedness.

Some of the more interesting and beneficial books I’ve read based on McCullough’s recommendations include:

Winning by Tim S. Grover, performance coach for Michael Jordan, Kobe Bryant, Dwyane Wade, business leaders and many others.

The Obstacle is the Way by Ryan Holiday.

Think Again by Adam Grant.

The Score Takes Care of Itself by the late San Francisco 49ers Head Coach Bill Walsh, who details how his “Standard of Performance” strategy of leadership resulted in him leading the franchise from National Football League laughingstock to three Super Bowl titles.

Lucky Me by National Basketball Association agent Rich Paul.

I pulled Winning from a shelf to find a good quote about Jordan’s competitive nature. Leafing through it, I found myself inspired to read it again.

McCullough underlines key sentences in the books he reads. I’ve often thought of doing the same thing with a highlighter but figured it would impede my enjoyment of the book. The problem with that is, while I remember at least one important message from most books, a lot of other valuable information drifts off into the ether.

To get better, and I know this isn’t a novel concept and many of you do this already, I’ll use a highlighter from now on.

Next Saturday: Overtrading & Procrastination

Disclosure: I do not have any financial arrangement with Hedgeye. I do not intend for this series to be instructional nor promotional. Dan Holland, Hedgeye’s Head of Media and Public Relations, has been gracious in making my writing available on Hedgeye’s website.

Prof Benoit helped convince me that the markets weren’t just casinos after I read all the math he presciently saw behind them — and Prof Keith gets the credit for pointing out the book 📕 KM might be Mandelbrot’s most brilliant, practical and applied student. I thank them both for showing me another path of learning that can benefit my own and extended families hopefully for many years after concluding the first career (which is coming up soon).

And thanks to you, Mr Mark, for writing up some really wonderful compilations of the Hedgeye Process and mission — have been absorbing and practicing with the Hedgeye team’s guidance for about three years also and agree with you, it really works. Hope and pray KM and HE reach those goals of education they’re so arduously striving toward, you are definitely helping! 🙏🏽