Pulling the Trigger on Physical Silver

How and why I bought "Silver Rounds" through Hedgeye's preferred dealer

I have always wanted to own physical gold and silver.

I’m not a survivalist. I won’t store my precious metals with gasoline, guns, and baked beans. And I don’t expect to have to trade them in some post-apocalyptic world for my neighbour’s two-headed goat.

So what’s the point?

Do I really need to own physical gold and siIver? Can’t I just own exchange-traded funds GLD and SLV that hold bullion bars in a vault for me? I could and sometimes do.

I just like the idea of having some gold and silver bars and coins on my desk and in a safe.

For the ascetics of it,

admiring them,

touching them (but not the silver too much because it will tarnish).

To diversify my portfolio of assets.

To give coins as gifts to family members so they can say, “What am I supposed to do with these?”

Oh yeah, and for the reason all precious metals’ bulls and bugs cite - to own hard money as a store of value.

Silver is a currency and has been for millennia but is not exactly widely used in corner stores these days.

And silver has over 10,000 industrial applications, increasingly in the solar industry, with the average solar panel requiring about 20 grams of silver, according to The Silver Institute.

But Silver also makes up a tiny portion of the commodities market and is notoriously volatile and tricky to trade.

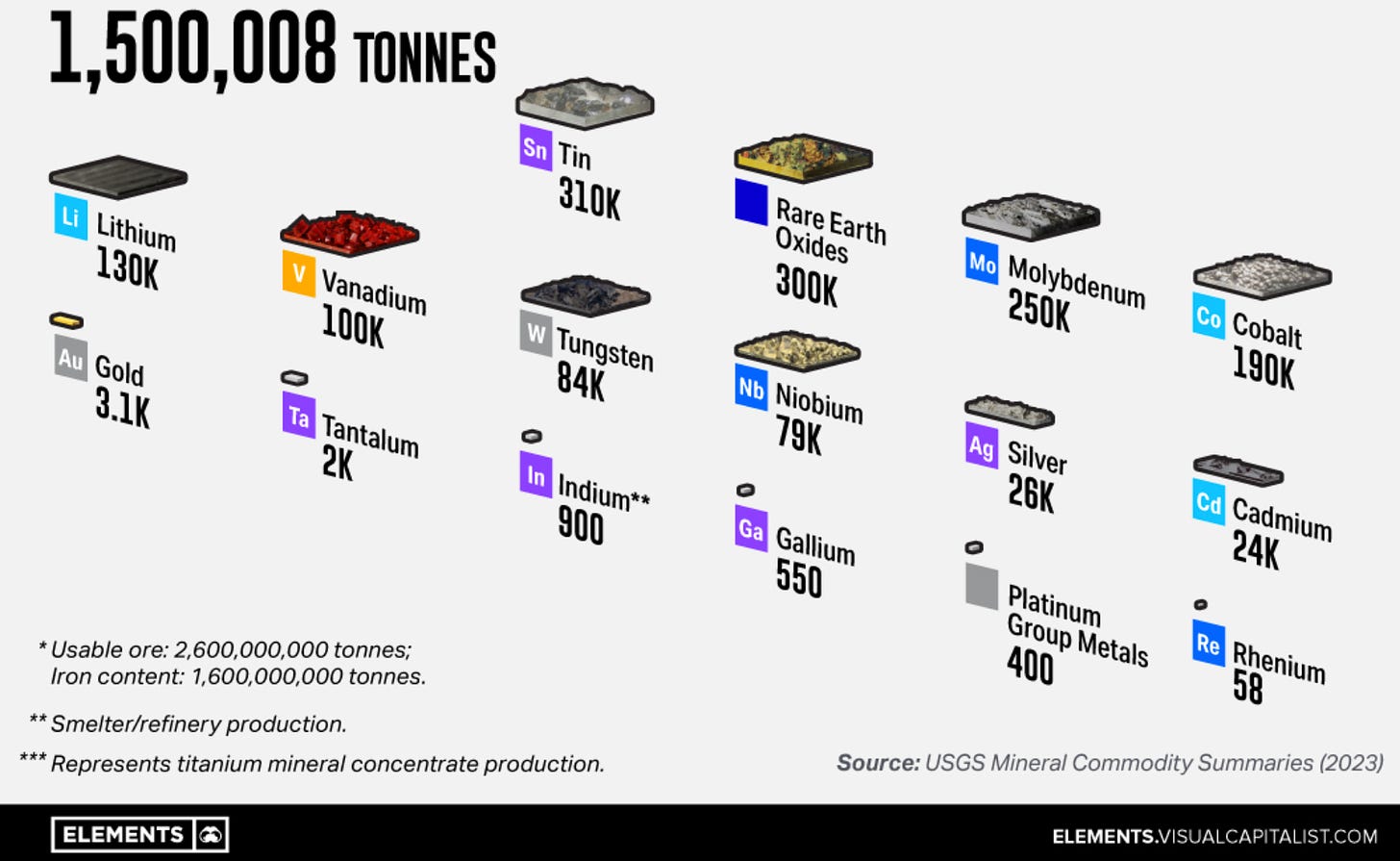

Technology and precious metals mined in 2022

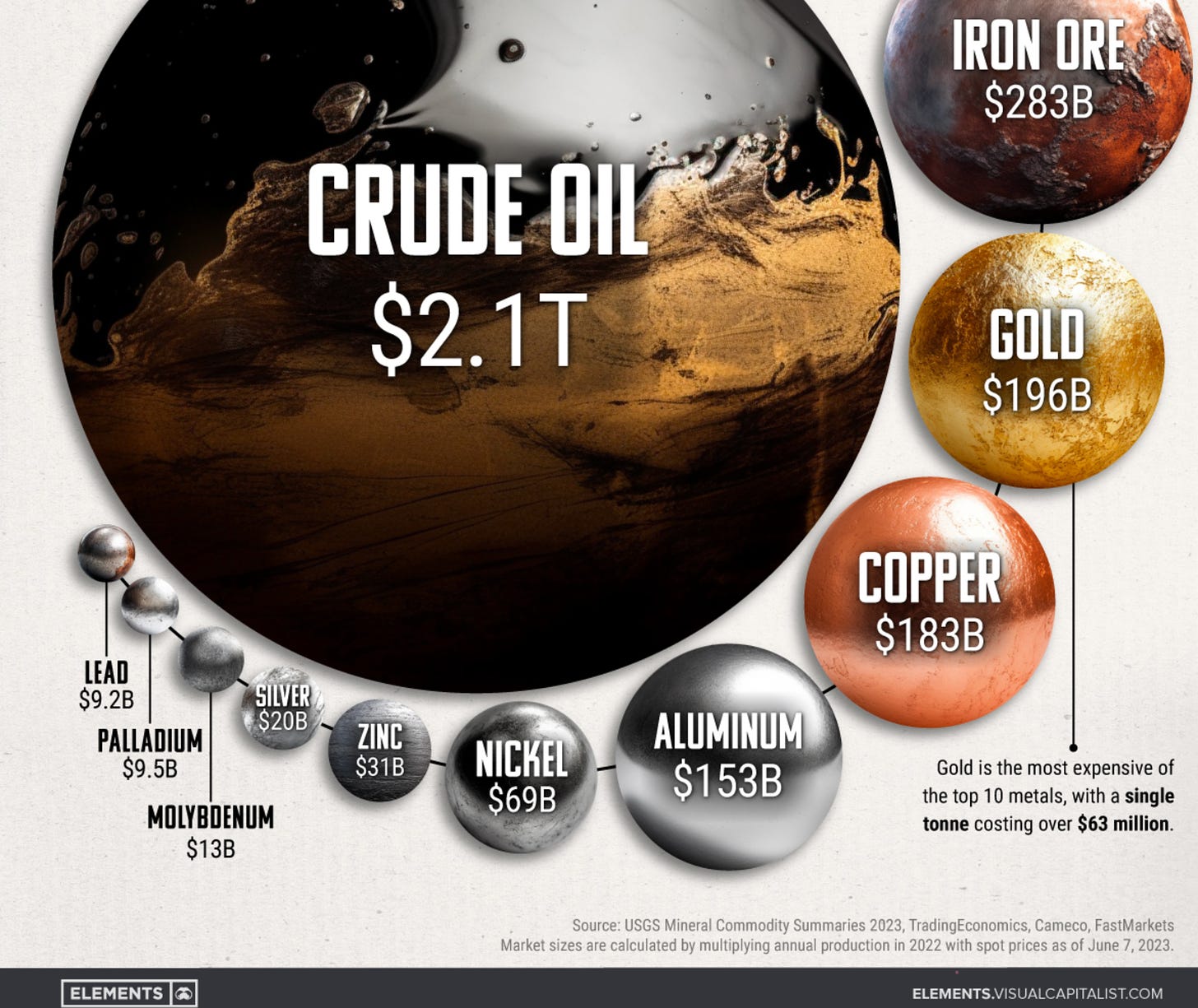

Top 10 metal market sizes vs. crude oil

I plan to hold my physical silver for years. There are only a few circumstances that would prompt me to sell. One would be if the price of silver soared to, say, US$150 an ounce. That would be about a ~4.5x increase from the current ~$34 an ounce.

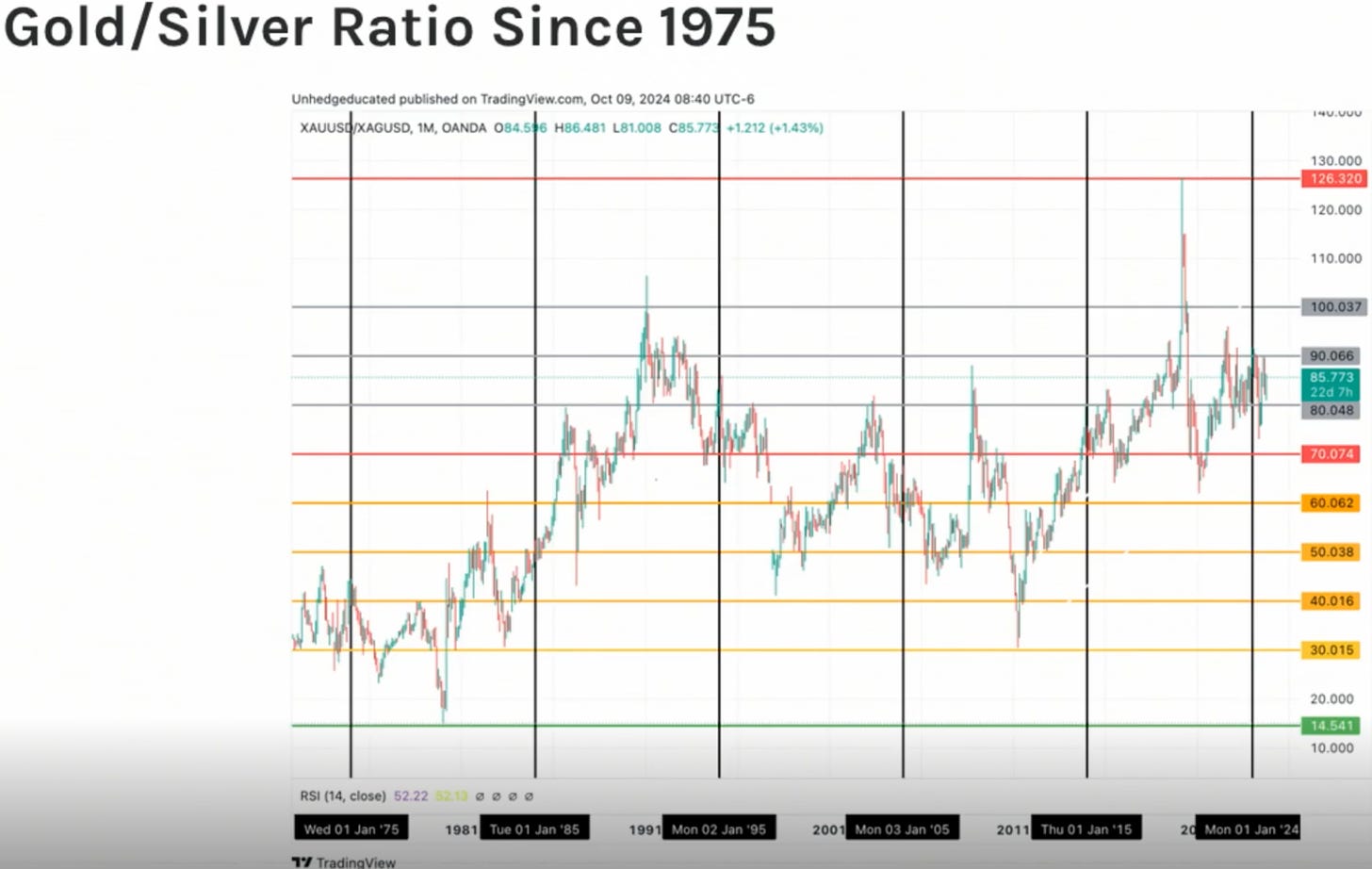

During that scenario, assuming gold at the same time has risen to about $4,500 an ounce*, that would put the gold/silver ratio around 30. The ratio currently sits at historically high 84 (84 ounces of silver to buy one ounce of gold).

(*The annual and free In Gold We Trust Report, co-authored by Incrementum AG fund manager and Managing Partner Ronald-Peter Stoferle, whom I interviewed recently, forecasts gold to hit $4,800 by 2030.)

There are many people who live in the world of clickbait who will tout what appear to be outrageous price targets for silver like $300 an ounce. Maybe it hits levels like that someday.

Until then, let’s see if it can breach $50 an ounce (non-inflation adjusted) as a start as it nearly did in 2011 and in 1980 when the Hunt brothers were trying to corner the market.

Two of the Hunt brothers (Lamar not shown) being sworn in at a House Subcommittee hearing into their roles in trying to corner the silver market. The Commodity Futures Trading Commission convicted them on charges in a New York Federal Court in 1988, fined each brother $10 million, and banned them from trading in the commodities market. The verdict, combined with an IRS lawsuit and civil cases, forced N.B. and W.H. Hunt to file for personal bankruptcy.

**

Another circumstance that would cause me to sell my silver would be if there was a significant change of some sort, such as a future Fed Chair hiking interest rates aggressively similar to Paul Volcker that could cause a multi-decade winter for gold and silver like 1980 to 2000.

But that scenario is unlikely given the ~$35 trillion debt pile of the U.S. The country’s interest payments on that debt already exceed $1 trillion annually, more than its military spending, so rates can only go so high before becoming untenable.

I’m buying physical silver because I am finally comfortable doing so. In the past, it wasn’t a priority to own it and when I would consider buying gold or silver, I would always assume that if I went to a bank or a dealer that I would get ripped off on the premium because I was a neophyte.

But after Hedgeye Risk Management thoroughly vetted McAlvany Precious Metals, a unit of McAlvany Financial Group in Durango, Colorado, and gave the over 50-year-old company its stamp of approval, I was ready to pull the trigger.

McAlvany sponsored Hedgeye’s recent Investing Summit and Hedgeye Founder and CEO Keith McCullough has bought silver from the company because he wants to own hard money along with his physical gold and he said he doesn’t plan to sell.

Silver also back tests well in Quad 3, along with other hard assets such as gold, platinum and palladium, when inflation is rising. Silver also continues to signal bullish trade and trend.

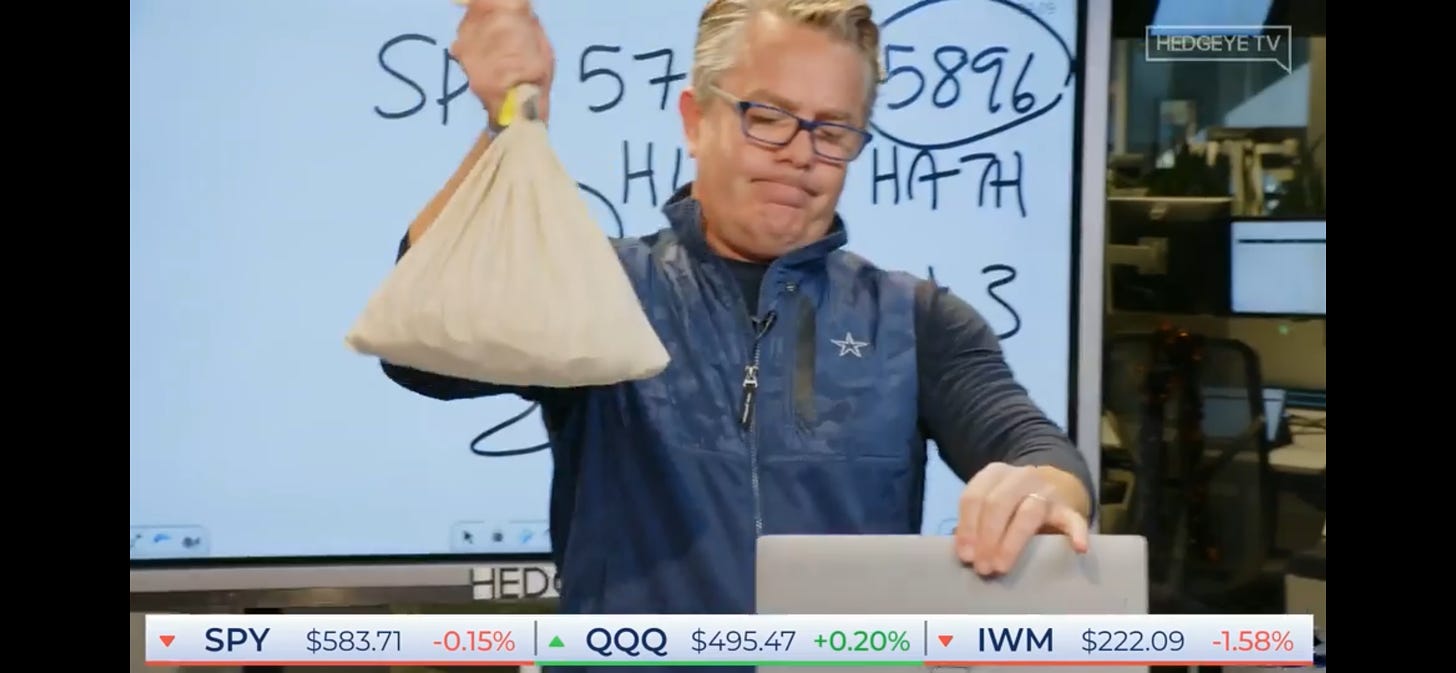

McCullough showed a bag of “junk silver” worth about $10,000 on The Macro Show.

McCullough introducing his bag of junk silver on The Macro Show

And he posted an Instagram video of his dog Boomer “guarding” the bag of coins.

McCullough’s dog Boomer guarding his junk silver

Junk Silver, as I’ve recently learned, is made up of pre-1965 U.S. coins with 90 percent silver content.

McAlvany Senior Advisor Eric Larkin was a guest during the Investing Summit and educated viewers on how the physical precious metals market works. He was informative, engaging and funny in his conversation with McCullough.

Eric Larkin, Senior Advisor, McAlvany Precious Metals, during his Investing Summit conversation with Keith McCullough

(I’ll be conducting a live Core Conversation with Larkin on YouTube on Thursday, November 7 at 1 p.m. eastern time as part of my role hosting interviews for Red Cloud Financial Services.)

During a call with Larkin, he advised me to begin by purchasing silver round one ounce coins.

He mentioned that the gold/silver ratio, which stood at ~80 at the time, was relatively high historically, showing that silver was undervalued compared to gold.

Gold/Silver Ratio chart Larkin showed during his Investing Summit conversation

Larkin also said there wasn’t a lot of demand for physical silver at the moment and that silver rounds had a relatively low premium of 2.3 percent above the spot price.

He told me that at one point in 2022, junk silver had a premium of 42 percent. That was when he was getting clients out of junk silver and into silver bars because they had a lower premium.

This so-called ratio trading strategy based on the gold/silver ratio and the corresponding premiums for various types of gold and silver bars and coins is what McAlvany calls compounding your ounces.

During this initial conversation, Larkin explained how physical silver is priced including the wholesale price, the premium and McAlvany’s commission.

I’ve talked about reinventing my former investing self in this series. There was a moment during my call with Larkin that was a microcosm of that effort.

I asked him whether I should buy the silver straight away, even though silver was near the top end of its Risk Range Signal. I was concerned that I could wait for weeks for it to hit the low end of its range and by then silver may have taken off to $40 or more.

Larkin calmly talked me off the cliff and said silver has a habit of pulling the rug out from investors, something I’ve experienced before with silver ETFs.

I also realized in that moment that I was getting my feelings involved and having a touch of FOMO. Exactly the opposite of following the process. Don’t chase, remember Mark?

I caught myself, did the right thing, and waited for silver to pull back to the low of its range, which at the time was just below $32 an ounce.

I want to own physical gold eventually, but the yellow metal is near all-time highs, at the high end of its Hedgeye Risk Range and carries a larger premium than silver at the moment.

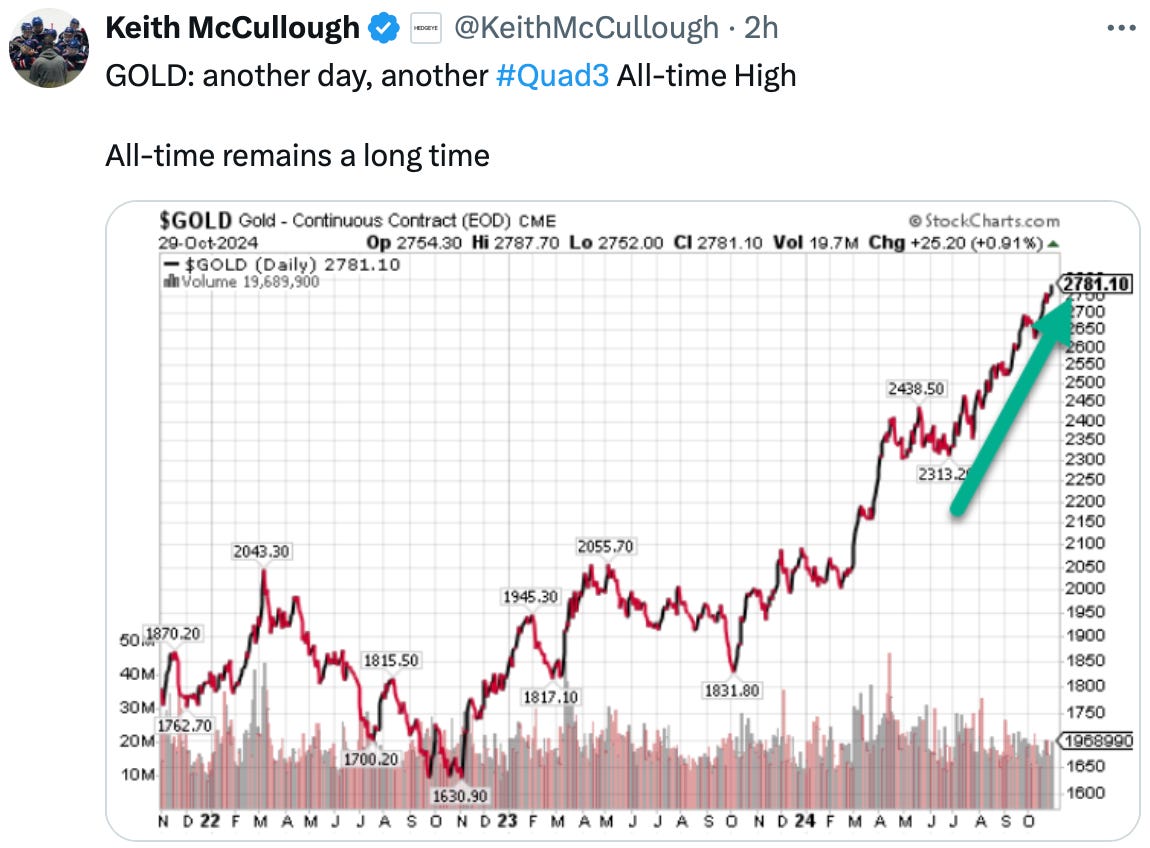

A tweet this week from McCullough on X

Larkin is a Hedgeye subscriber and incorporates McCullough’s Quad setup, signal strength, and Risk Range levels into his decision-making for clients.

My chance to lock in my initial purchase of physical silver happened this past Thursday when the spot price was pennies away from the low end of its range of $32.58 an ounce.

I messaged Larkin to ask whether he thought it was time to buy. He called me a few minutes later when I was heading downtown in an Uber. Larkin agreed it was a good time to “take a bite” and lock in a portion or all of the amount of silver rounds we had previously agreed to.

I told him how many coins I wanted. He said he would lock in the price and his colleague would be in touch with wire transfer instructions. I sent my wire transfer. Once it clears, a FedEx delivery person will arrive at my door later this coming week with my package of silver rounds.

I am patiently waiting and curbing my enthusiasm to take delivery. Although, opening the package will be fun.

My plan is to accumulate physical silver and gold coins and bars until I think I have a sufficient amount. I will then have any future purchases held by McAlvany’s depositor in Colorado.

Those buys will be based on Hedgeye’s Quad outlook, Risk Range Signals, the gold/silver ratio, premiums, and Larkin’s advice on the best way to compound my ounces.

I also plan to supplement my physical holdings with high-quality gold and silver stocks and an ETF or two. This week, I bought Kinross Gold, for example.

In Hedgeye’s Portfolio Solutions Daily ETF Re-Rank this past week, McCullough was buying more gold and silver in GLD, AAAU, SLV, gold miners (GDX), and added silver miners (SIL), and junior gold miners (GDXJ).

All that’s left to say is the Lone Ranger’s famous command to his fast and fiery horse Silver, “Hi-yo Silver, away!”

🪙 Thanks for info and the links to your interview with Larkin, will listen soon.

When we decided to buy silver from reputable sources as you are doing, we also went with silver rounds to begin with because of the lower premium, then well-known brand name bars, then later we graduated to silver Eagles and Maple Leafs and Kangaroos/Koala Bears etc, which might have more liquidity than rounds but ultimately they’re all silver and they’re all gonna go up in value!

If I may express some concern 😯 I don’t know where exactly FedEx delivered for you, so I’d like to suggest for privacy reasons that you send to a work address or PO Box, not home address. Packages of silver are heavy, as I’m sure you’re noticing, and can attract unwanted attention.

Best place of all to get physical silver and gold is a local coin show! Lowest premiums, no shipping charge, and giving an address is totally unnecessary! Enjoy❗️

Buying tangibles like silver or gold is the right move as the fiat dollar is eviscerated by the central bank to fund bloated government. I'm with you on that and I've been buying metals since about 2010 knowing this day was coming. However, rounds have a problem. I know the purchase price is very attractive, but it's very difficult for prospective buyers to know if they're real and what the purity is. You can probably sell to a dealer with test gear and enough familiarity to spot fakes, but I wouldn't buy your rounds. There are so many different rounds that I can't possibly keep up and maintain familiarity with each. I was recently approached by a woman who wanted to sell her deceased husband's silver. I took a look at her silver and spotted fake Eagles immediately. I had to walk from the deal because the rounds and bars were even more difficult and her husband had clearly been defrauded by whoever sold him the Eagles. For this reason, I pay a little more to purchase sovereign minted coins. My favorites are the Maple Leaf and the Britannia. Both have such fine engraving details that it stymies the counterfeiters and I can spot a fake in about ten seconds. That makes them better for use in commerce. That's my suggestion for you. Good luck.