Warning: Don’t Go Rogue from the Hedgeye Process

My self-inflicted debacle with a tail risk ETF

The first rule of the Hedgeye investing process is preserve and protect your capital.

The innovative risk management system created by Founder and CEO Keith McCullough is designed to prevent major drawdowns.

Why wear a 75 percent plunge in a stock such as Meta between August 2021 and October 2022 if you can limit your loss to five or six per cent?

I witnessed both sides of that scenario close up.

Hedgeye, at the time, was advising self-directed subscribers and institutional clients to get out of Meta because Andrew Freedman, the company’s Communications Head and Software Co-Sector Head, had turned bearish on Meta’s fundamentals, and the stock had broken McCullough’s bullish trade and trend levels and flipped to bearish trade and trend.

Meanwhile, a former colleague who runs an investment firm didn’t sell Meta and rode it down to its ultimate bottom because he believed in the company and thought that the market and the media had the story wrong.

In late 2022, Freedman was quick to recognize that Meta’s business was inflecting and went bullish again, and McCullough’s signals eventually showed bullish trade and trend for the stock.

Hedgeye subscribers following the process would have exited their Meta position before the big drawdown and would have captured most of the stock’s subsequent large move higher when the signal said to buy.

Longer-term, my former colleague was right about Meta. The stock eventually surged nearly 500 percent between November 2022 and April 2024.

But prior to that, he and his unit holders in the company’s main equity fund and those in segregated client accounts suffered a massive loss on paper.

Would you rather get out with a less than 10 percent loss, possibly have to pay some capital gains tax, and redeploy the capital or take that kind of hit?

The answer should be obvious to most unless you’re a very long-term investor with a multi-year or multi-decade time horizon and willing to wait out huge downturns because you believe in a company’s long-term prospects.

100 Bagger Stocks

Christopher Mayer is that kind of investor. He’s the Portfolio Manager and co-founder of Woodlock House Family Capital, and the author of the book 100 Baggers: Stocks That Return 100-to-1 and How to Find Them.

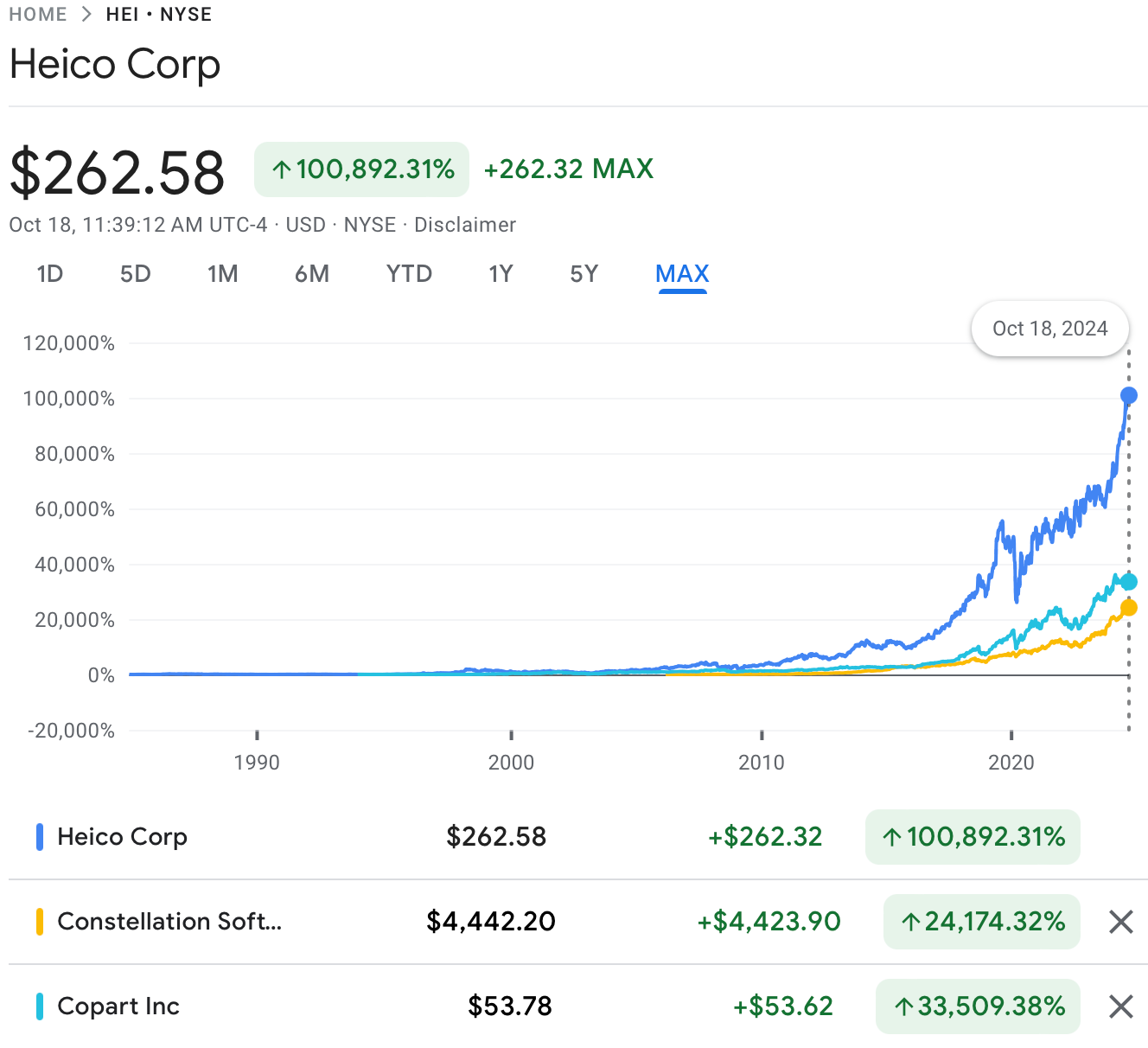

Mayer runs a very concentrated portfolio made up of names like Constellation Software, Copart and Heico, and holds some positions for decades without selling a single share. That is a different way to invest than the Hedgeye way and that works for him.

$100 invested in Heico in late 1984 would be worth ~$10,089.231 today.

For people who don’t have that kind of patience, the Hedgeye process helps to keep an investors’ losses to a minimum.

Daryl Jones, Director of Research at Hedgeye, has said he allows for about a six percent loss in a position before deciding to get rid of it.

Feed Your Winners, Starve Your Losers

Feed your winners and starve your losers is another way of putting it. That’s a phrase McCullough has cited from a book by Ken Hersch, a private equity investor, called The Fastest Tortoise.

For McCullough, a loss of three or four per cent in a position would be unusual because his signal would alert him that a ETF or stock is losing signal strength, hitting lower highs and lower lows, and likely has broken its trade and trend levels.

A loss of three or four percent over a trading session or two in McCullough’s long-only ETF portfolio or personal account would also be unusual. He doesn’t fall in love with or emotionalize his positions.

“They’re just tickers.” McCullough has said he “feels nothing” when a position stops working and he hits the button to dump it.

Going Rogue

I’m still working on the dispassionate aspect of my investing process although I’m quite good at not allowing my emotions to interfere with my judgment.

But the most extreme example of me deviating, or going rogue, from the Hedgeye process was CYA (cover your ass), the ticker for a defunct Simplify Tail Risk ETF.

Tina Fey as Sarah Palin “going rogue” on Saturday Night Live

One day on The Macro Show, McCullough mentioned CYA had gone up 17 percent in a single session.

The ETF, like similar tail risk ETFs, is designed to deliver outsized gains when there is a large drop in the major stock indices caused by a sharp economic downturn or even an exogenous Black Swan event.

McCullough had mentioned CYA in passing and it wasn’t on Hedgeye’s ETF Pro Plus list. In fact, a few days later, he advised subscribers to steer clear of CYA because he didn’t like its construction or something similar.

Did I follow McCullough’s advice? Nope.

Ol’ Marky’s worst instincts were triggered because I believed I could hit a grand slam - out of the ballpark onto the street below - if an expected U.S. recession happened and some sort of unexpected Black Swan event occurred.

I figured if I devoted three or four percent of my personal account to CYA and waited, then at some point I could make a massive return.

If it worked for Mark Spitznagel, then it can work for me.

The founder, owner and Chief Investment Officer of Universa Investments, and the author of The Dao of Capital: Austrian Investing in a Distorted World, made huge gains during the financial crisis by deploying a tail risk strategy.

So, I waited for CYA to pull back and bought some. It pulled back some more; I bought some more.

I was down 20, 30, 40 percent in no time as I kept adding to my position, refusing to take the early losses and now enduring large losses.

Self-Flagellation

Holding on to CYA then became almost an act of self-flagellation. I turned my idiotic actions into a lesson: do not do anything so stupid again.

As part of that punishment, I believed I deserved to see CYA go to zero. CYA obliged and continued to sink deep below $1 a unit while I maintained a flicker of delusional hope that it would turn around.

Simplify, in a flailing attempt to prop it up, executed a 1-for-20 reverse consolidation, but it made no difference.

CYA eventually declined by 99.8 percent and Simplify liquidated the remaining $1.7 million worth of assets.

I achieved my perverse goal and watched my money evaporate.

A shameful episode in my investing life and a lesson learned. My behaviour ticked every box on what not to do, including hubris, recklessness and more.

Throughout, I assumed McCullough would be appalled if he knew about my actions.

There. Writing that down was cathartic, I think.

Bottom line: preserve and protect your pile, cut your losses early, avoid major drawdowns and stay within the process.

Next Saturday: Go Anywhere

**

Disclosure: I do not have any financial arrangement with Hedgeye Risk Management. I do not intend for this series to be instructional nor promotional. Dan Holland, Head of Media and Public Relations for Hedgeye, has been gracious in making my writing available on the company’s website.